The ultimate financial wellbeing platform

On the hunt for employee benefits, salary sacrifice, financial coaching or shopping discounts?

Maji is a UK financial wellbeing provider that makes saving, spending, and planning money simpler for employees and employers.

If you’re thinking money, think Maji.

Rated Excellent by our customers

What Maji does

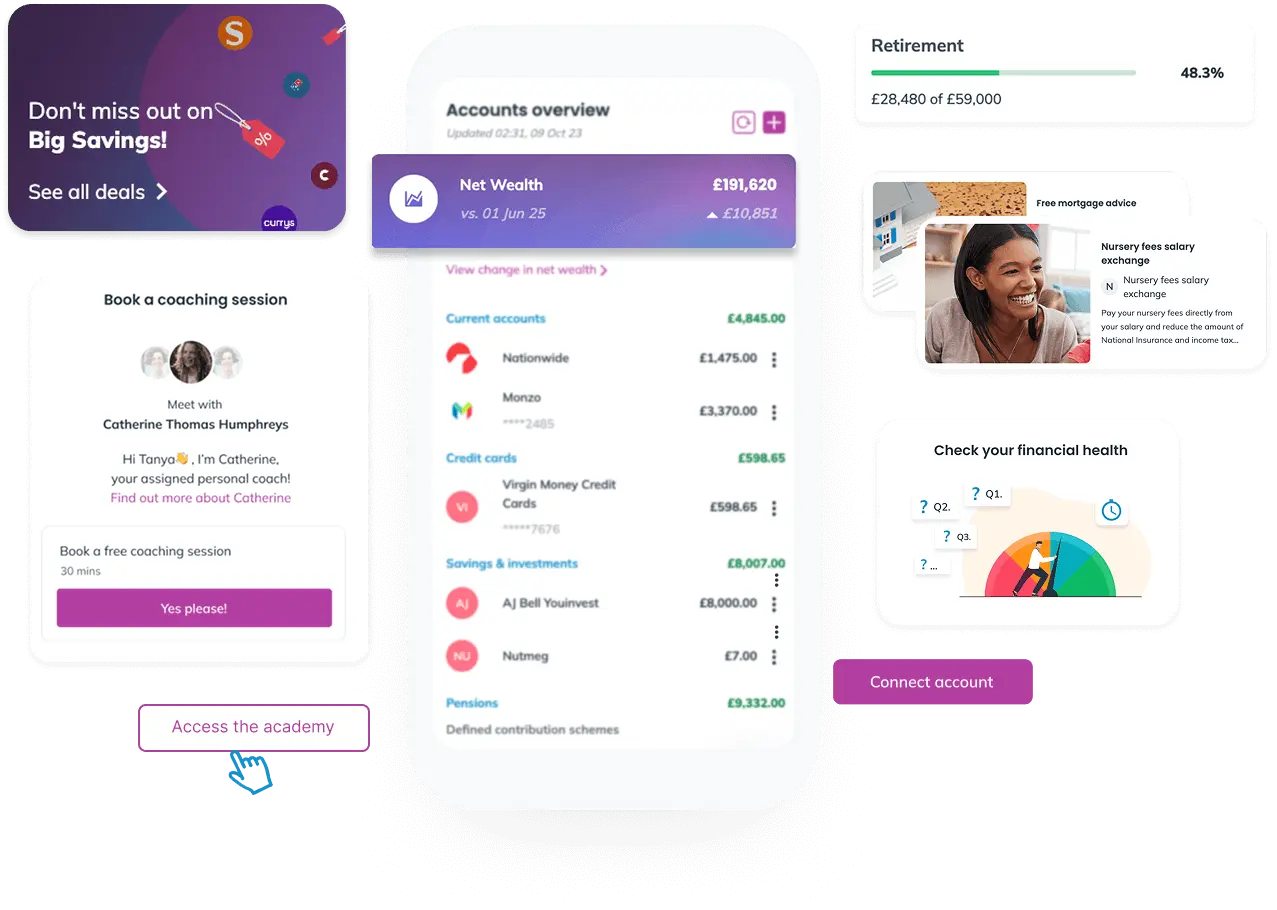

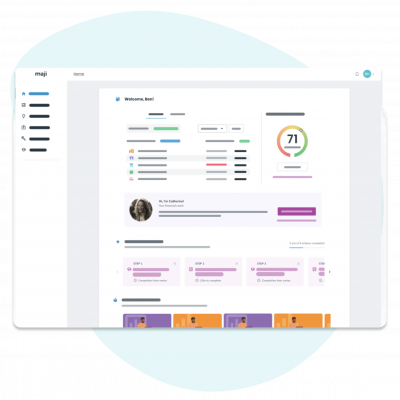

Maji brings financial wellbeing together in one digital platform.

Employees can manage their everyday money, access personalised financial coaching, and make the most of benefits like salary sacrifice and workplace savings – all from one place.

HR teams use Maji to support employee financial wellbeing, improve engagement, and deliver meaningful benefits without added complexity.

Why you need a financial wellbeing solution

Financial education that creates change

Personalised learning journeys based on real-life goals, not generic content.

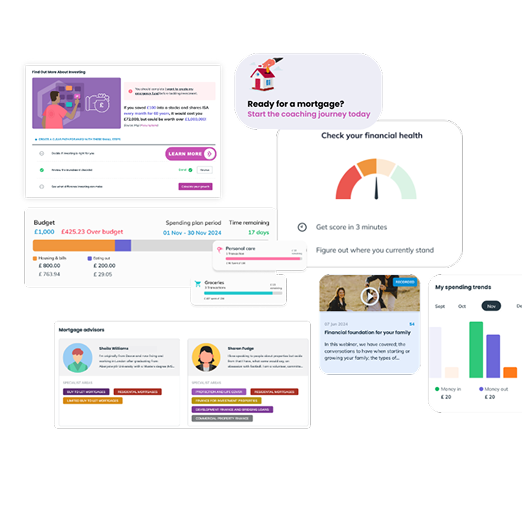

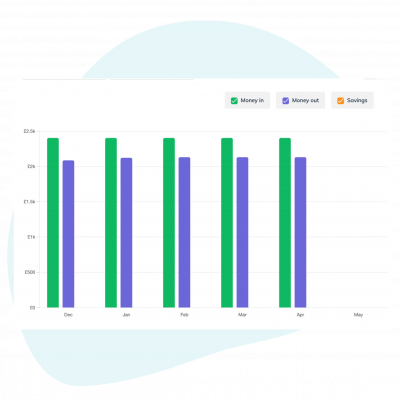

Money tools that drive action

From budget planners and savings goals to open banking, salary sacrifice, mortgage guidance and more.

Financial experts on demand

Access to qualified financial coaches, advisors and specialists, whenever they’re needed.

Who we help…

What employers get with Maji

- Salary sacrifice schemes that save on NI

- Employee discounts that save on everyday expenses

- Life changing financial coaching

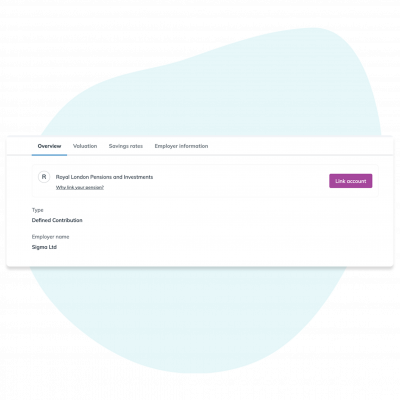

- Pension engagement tools that drive higher contributions (and NI savings)

- Mortgage and will planning support for your team

- Plus more, all in one digital platform

What partners get with Maji

- Add value to your proposition with a proven digital solution your clients will love

- Drive client engagement with built-in tools, financial coaching and insights

- Seamlessly integrate financial wellbeing into your existing offers

What users get with Maji

- One-to-one support from financial coaches to help employees save, plan ahead, and build confidence with money.

- Simple tools to budget, track spending, and plan for short- and long-term goals.

- Support for career starters, parents, homeowners, and those planning for retirement.

- Exclusive retail discounts and offers on everyday essentials

As an employer

- Salary sacrifice schemes that save on NI

- Employee discounts that save on everyday expenses

- Life changing financial coaching

- Pension engagement tools that drive higher contributions (and NI savings)

- Mortgage and will planning support for your team

- Plus more, all in one digital platform

As a partner

- Add value to your proposition with a proven digital solution your clients will love

- Drive client engagement with built-in tools, financial coaching and insights

- Seamlessly integrate financial wellbeing into your existing offers

As a user

- Personalised guidance to take control of your money

- Unlimited access to qualified financial coaches

- Tools to track spending, set goals, and save more

- Exclusive retail discounts and offers on everyday essentials

Think NI savings. financial wellbeing. pensions. salary sacrifice. employee support. Think Maji.

Think

NI savings.

financial wellbeing.

pensions.

salary sacrifice.

employee support.

Think Maji.

How Maji is different

Maji costs less than a monthly coffee…

but delivers so much more. Our digital-first model keeps costs low and impact high, often delivering 100% ROI through National Insurance savings alone.

And that’s before you factor in the gains in engagement and productivity.

Forget generic financial content.

Maji tailors every experience of the user’s money journey.

From educational content and money tools to 1:1 expert coaching, our platform is based on each user’s unique goals, challenges and life stage.

With Maji, you’ll get the right support, at the right time.

Refine your employee benefits strategy based on data.

We combine behavioural science, usage insights and employee feedback to show you where your people are struggling, and succeeding.

Use these insights to refine your benefit strategy and show leadership the real impact of your investment.

Maji turns good intentions into action.

From boosting pension contributions to saving for emergencies, writing a will or accessing salary sacrifice schemes – everything happens in one place.

No dead ends. Just real progress.

Why Maji?

- Delivers real impact - proven to boost pension contributions, reduce financial stress, and support retention and engagement

- Backed by behavioural science – designed to drive action, with high engagement and user satisfaction

- Trusted across industries – used by SMEs and corporates alike to enhance financial wellbeing strategies

- Secure and compliant – ISO certified and GDPR-ready

- Accessible anytime, anywhere – available 24/7 via desktop or mobile app

Ready to support your people and your business?

Testimonials

Wish we had it earlier!Maji was really easy to set up and the team were really quick to answer any questions me or my team had. It’s added a lot of value to the team and a lot of them are already receiving coaching and making changes to their lifestyle.

We’ve had glowing reports back!We’ve had glowing reports back from employees on their 1-1 coaching experience and the impact on pension savings has been phenomenal. We also love how Maji helps employees better understand our full benefit offer.

Maji is a cost effective solution!Maji's product offers a cost effective solution for our clients. It provides leading edge technology to simplify the financial healthcheck process and offers coaching and financial advice as a package which continues outside of the Workplace.

Free 1:1 coaching session was very insightful The free 1:1 coaching session was very insightful and a great tool to discuss a sensitive, personal topic. I felt like I could speak freely with my coach about confidential information, in a judge-free environment. Their portal has lots of additional content which I look forward to learning from.

I had a really great coaching session! The advisor listened without judgement and explained all options in an easy to understand way. It helped me reframe my thinking and make better decisions for the future. The app itself is also really useful when it comes to keeping track of finances.

The app is absolutely fantastic Our charity has just started to launch Maji and the app is absolutely fantastic. The instant chat has a quick response rate and all the advisors on there have been super helpful. I cannot wait to start reaping the benefits!

I can view all my finances clearly in one place Maji is a great tool offered to me as a workplace benefit via my employer. The app is great and allows me to view all of my finances clearly in one place. The real value of this platform comes from the coaching sessions that you can book with real advisors. They take the time to understand your scenario and goals before then helping you understand how to use the financial tools available.

Blogs

Bonus exchange salary sacrifice: UK employer guide

Why a will is the ultimate act of financial self-care (and how to get started)

Salary sacrifice schemes: what are they and how do they work?

Financial wellbeing FAQs

What is employee financial wellbeing?

Employee financial wellbeing means having the knowledge, tools, and support to manage money day-to-day, plan for the future, and cope with financial shocks without ongoing stress.

How does Maji support financial wellbeing at work?

Maji combines financial coaching, digital money tools, and access to workplace benefits in one platform, making financial support easy to use and relevant to real life.

Is Maji only about pensions?

No. While pensions are important, Maji supports the full financial picture — including savings, budgeting, family costs, and long-term planning.

Who is Maji for?

Maji is designed for UK employers who want to support their people’s financial wellbeing, and for employees who want simple, trusted guidance with money.

What is employee financial wellbeing?

Employee financial wellbeing means having the knowledge, tools, and support to manage money day-to-day, plan for the future, and cope with financial shocks without ongoing stress.

What does Maji do?

Maji is a UK-based financial wellbeing provider supporting employees and employers with financial education, coaching, and workplace benefits.